Popular Fraud Tactics & Scams

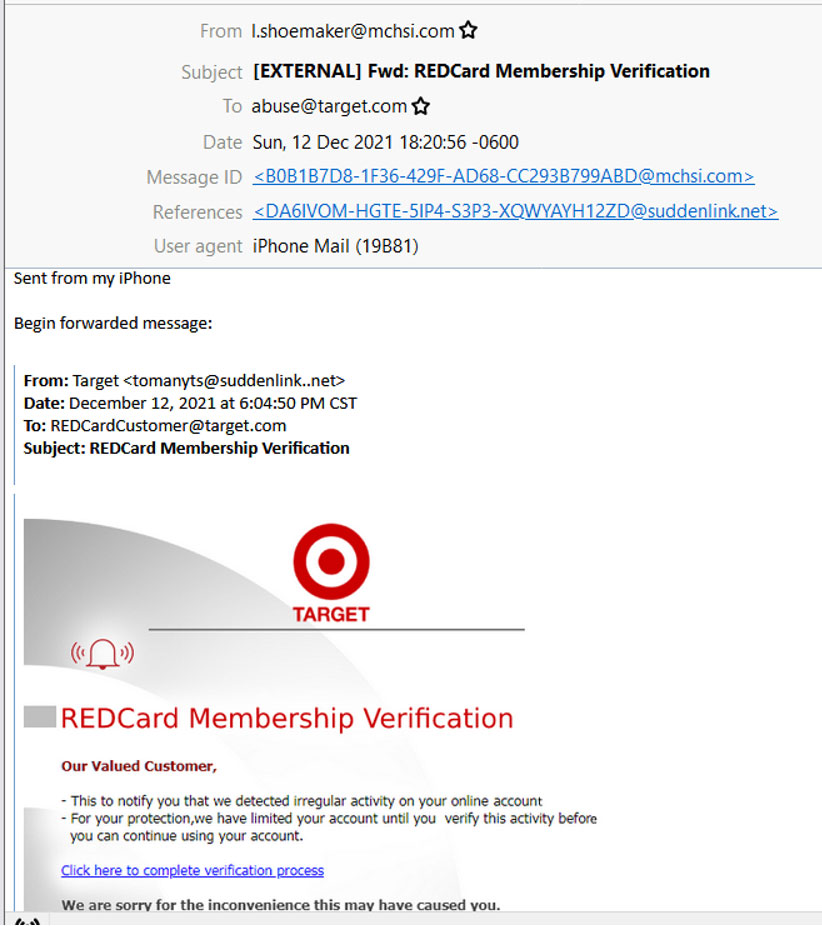

Phishing (Email)/Vishing (Voice)/Smishing (SMS Text)

Scam occurs when a fraudster uses the Target brand to trick guests into sharing sensitive information such as usernames, passwords, account numbers or other personally identifiable information. This tactic comes in multiple forms: phishing (via email), vishing (via voice), or smishing (via text message), and sometimes looks like legitimate communication from Target or another retailer.

Fake Target.com Order Scam

Occurs when a fraudster creates a fake "thank you for your recent purchase" email or text from Target. The goal is to trick the recipient into reporting that they did not place the order by using a phone number or link provided in the fraudulent email or text. The scammer will then attempt to collect login credentials, payment information or other personal details that can be used to carry out additional fraudulent activities.

One-Time Password (OTP) Social Engineering Scams

One-Time Password (OTP) social engineering attacks exploit human behavior to bypass security measures that rely on OTPs for authentication. Attackers trick users into revealing their OTP by posing as trusted entities, such as banks or service providers. Common methods include phishing, phone calls, or fake alerts that create a sense of urgency, convincing users to share the OTP in the belief that they are preventing fraud or verifying legitimate activity.

Circle Card

Scammers may call you pretending to be from Target's fraud department, asking for your credit card details for "verification" or to address a supposed issue with your account. These scams are a common way for fraudsters to steal your card information and money.

Key warning signs to look for:

- Requests for personal card information (full card number, CVV, PIN)

- Pressure to take quick action

- Vague information about your account (recent transactions, account number)

Actions to take:

- Hang up immediately

- Do not share personal information

- Report the call (details below)

- Monitor your accounts

Taken from target.com:

- Target Circle Card & Target Mastercard: +1-800-424-6888 Target

- Debit Card: +1-888-729-7331

- Send us a message Email: abuse@target.com

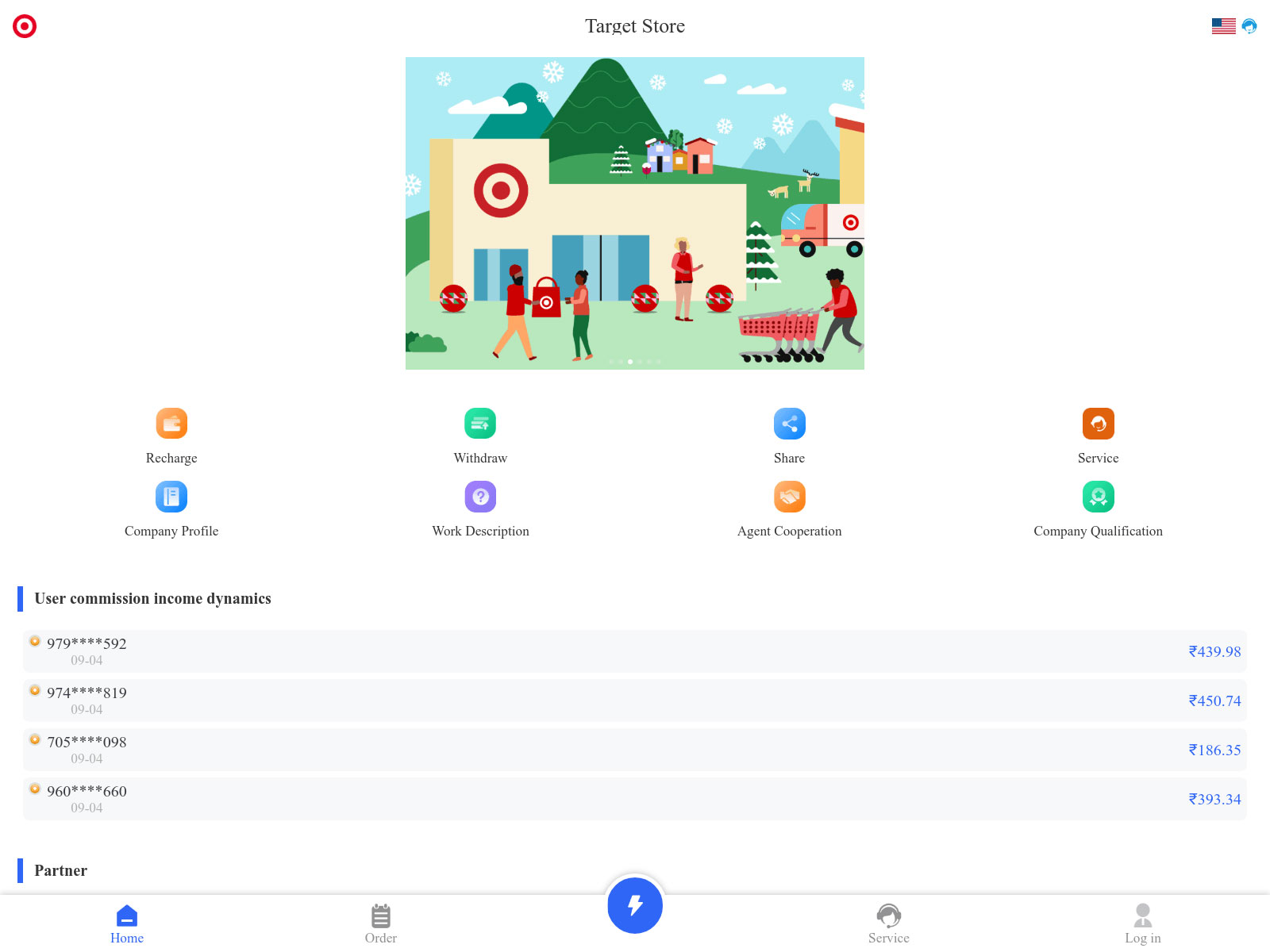

Investment Scams

Scammers often target individuals with promises of high returns with little to no risk. These scams can take many forms, such as:

Ponzi Schemes: These scams involve paying returns to existing investors from money collected from new investors, rather than from actual profits.

Pyramid Schemes: These scams rely on recruiting new participants to generate profits for existing members, rather than through the sale of goods or services.

Cryptocurrency Scams: Scammers often promote fraudulent cryptocurrency investments or offer fake cryptocurrency exchanges.

Be cautious of investment opportunities that seem too good to be true. Always do your research, verify the legitimacy of the investment, and consult with a financial advisor before making any investment decisions.

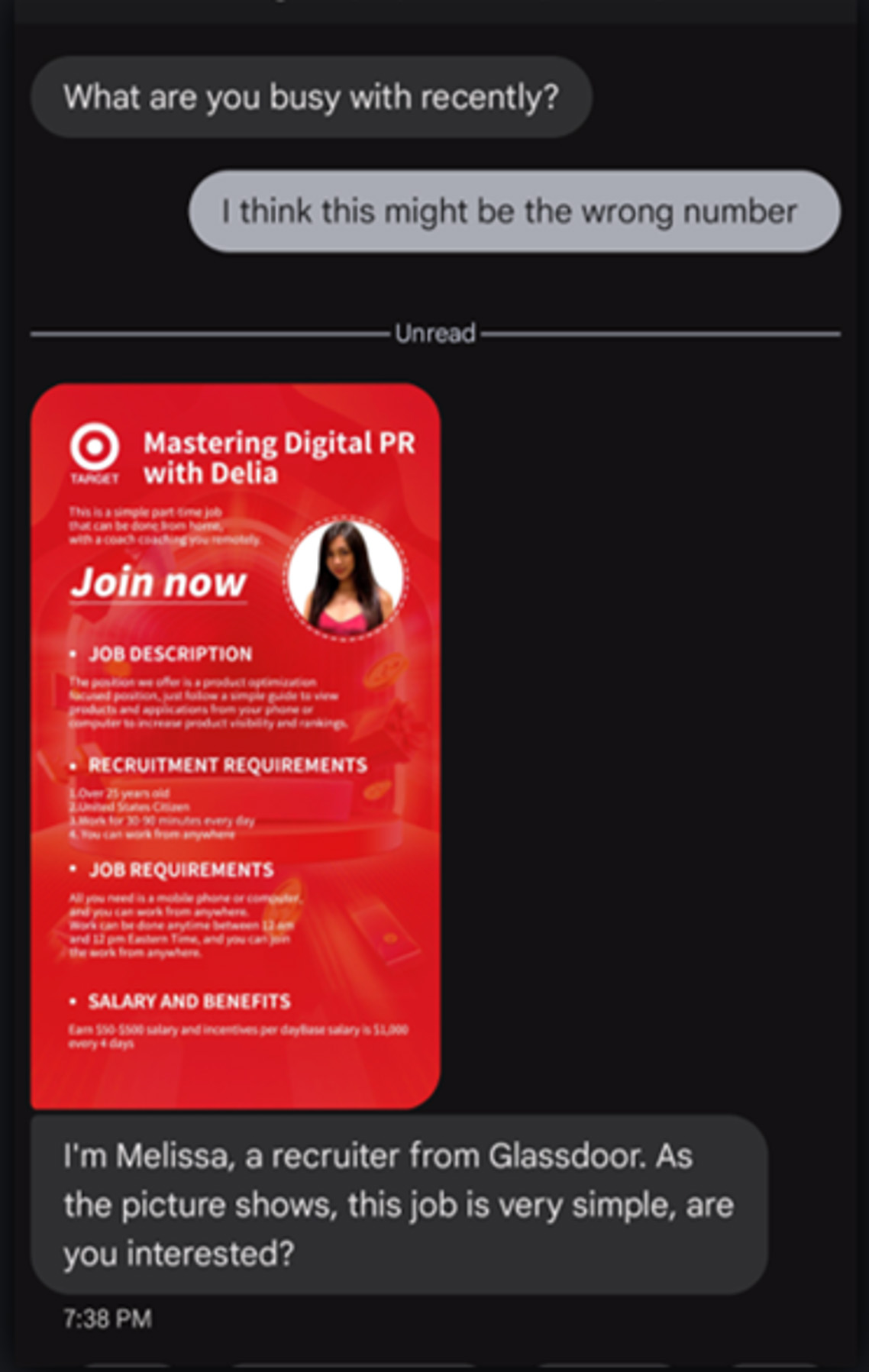

Job Scams

Scams often include imposter and secret shopper scams. Typically, the fraudster will contact their victims via email, posing as Target with a flash subject line such as, "job offer" or "influencer opportunities." Each role will have a brief job description which is used as a call to action, luring in potential victims by offering compensation or free products. Once they establish communication, this victim is instructed to share personal information, purchase and share gift card numbers, or buy certain items to review.

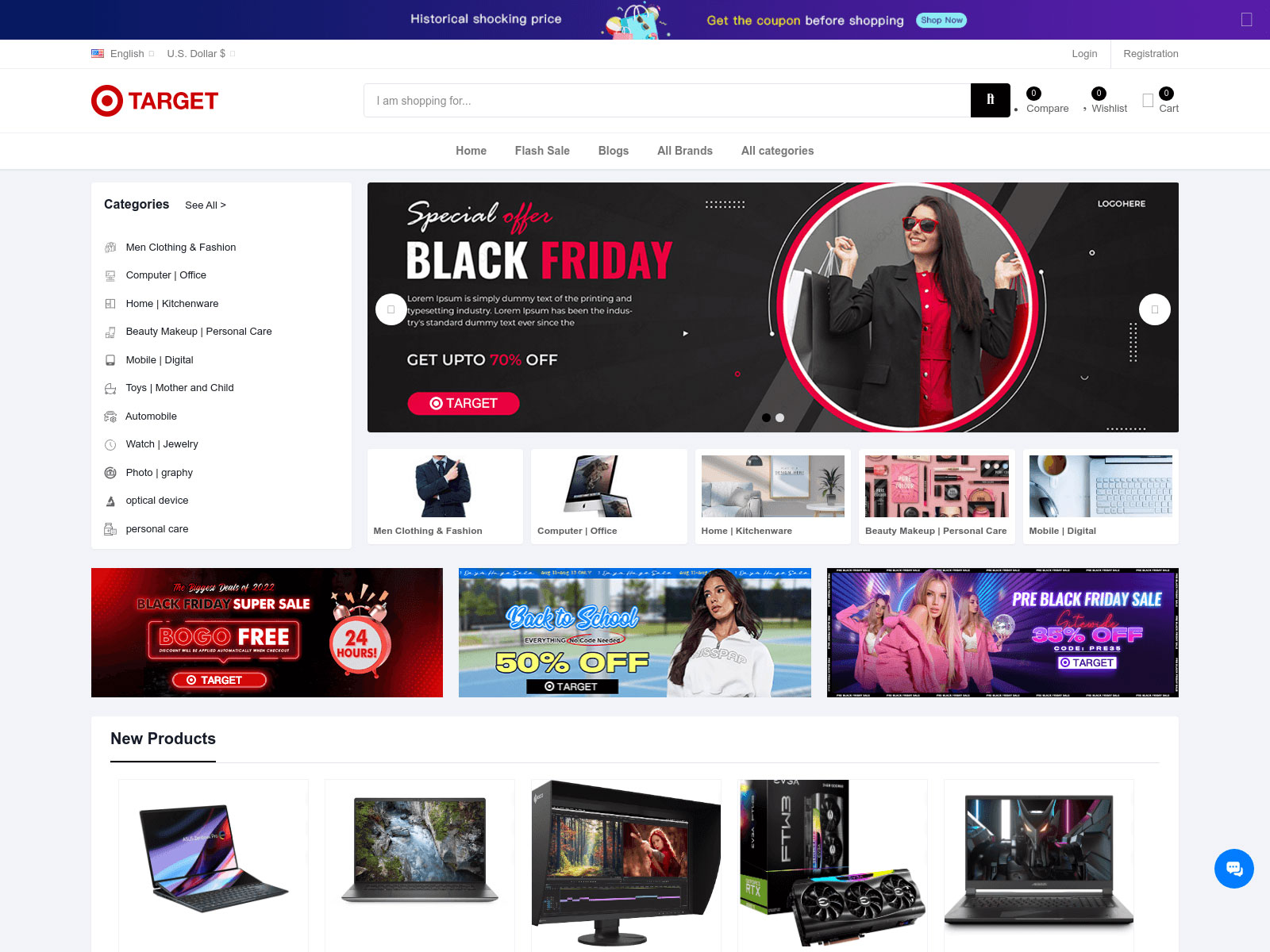

Malicious Online Merchants Scams

Be cautious of online merchants, especially those that advertise on social media platforms like TikTok and Instagram. These merchants may use deceptive tactics to trick consumers into providing their personal and financial information. Common tactics include:

Phishing scams: Scammers may send you emails or messages that appear to be from legitimate online merchants, asking you to verify your account information or update your payment details. These messages often contain malicious links that can lead to fraudulent websites.

Fake product reviews: Scammers may use fake reviews or testimonials to promote their products. Be wary of online merchants with an overwhelming number of positive reviews, especially if they seem too good to be true.

Hidden fees: Some online merchants may charge hidden fees or shipping costs that are not disclosed upfront. Always read the terms and conditions carefully before making a purchase.

When shopping online, be cautious of merchants that:

- Have limited or no contact information

- Require you to pay upfront with a gift card or wire transfer

- Have a history of negative reviews or complaints

Before making a purchase, research the merchant and check for reviews from other customers. Consider using a credit card to protect yourself from unauthorized charges.